Cashmallow Expands to Thai Market: Launches Money Exchange and Remittance Services.

Saving Over HKD 700 Compared to Traditional Banks

Fintech company Cashmallow has officially announced its entry into the Thai market with the launch of “Thailand Remittance and Currency Exchange Services,” aiming to provide local users with more competitive cross-border payment solutions.

Cashmallow, a pioneer in the fintech industry, has consistently addressed user challenges in cross-border transactions through innovative technology. Founder and CEO Yun Hyeongun highlighted issues with existing platforms, such as lack of transparency and high fees, which compromise customer interests. The company is committed to reshaping overseas remittance experiences by offering simple, transparent, and worry-free transactions, ensuring better value for its customers.

Already licensed as a Money Service Operator (MSO) by Hong Kong Customs, Cashmallow guarantees the legality and reliability of its services while adhering to the highest standards.

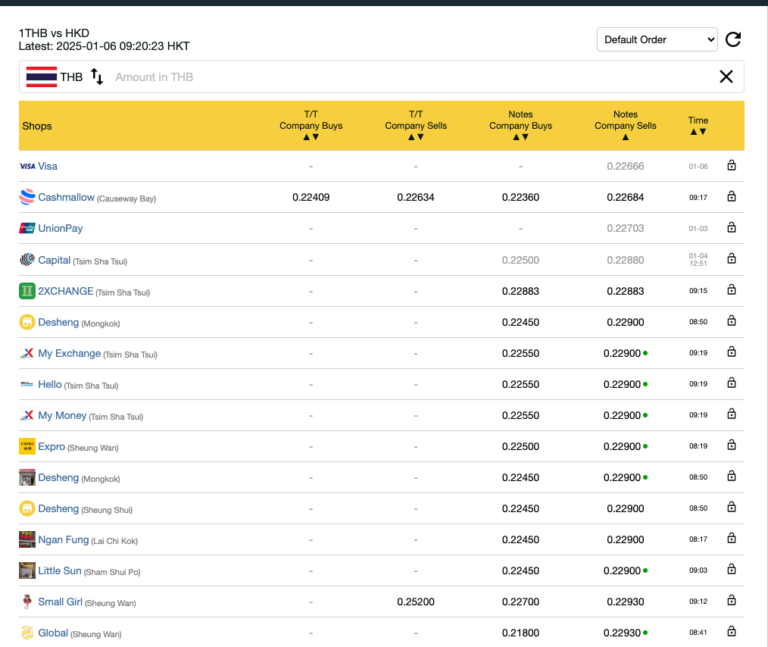

As economic ties between Hong Kong and Thailand grow stronger, the demand for low-cost and efficient cross-border payment solutions is surging. Cashmallow’s expansion is expected to bring new competition to the local market.

With offices in Japan, South Korea, and Singapore, Cashmallow is well-prepared to offer an even broader range of cross-border payment services in the future.

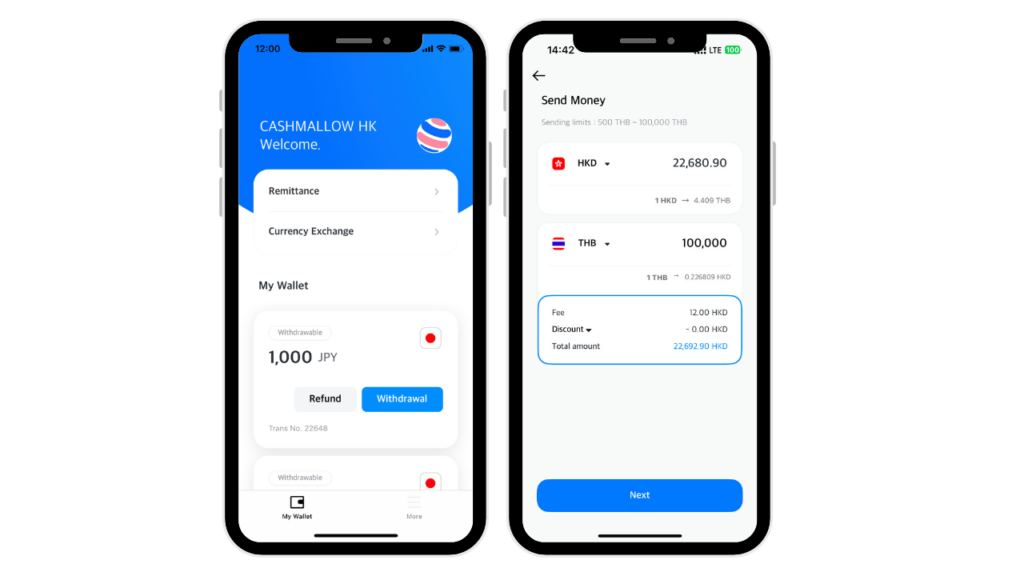

Cashmallow’s “Thailand Remittance and Foreign Currency Exchange Service”

The Thailand remittance service allows you to transfer Hong Kong dollars to a Thai bank account seamlessly. Previously, Cashmallow invited Thai-based YouTuber 奇在泰國 Kiinthailand to test the actual remittance speed. The result? Funds were credited in just 4 minutes!

(Image Source: 奇在泰國 Kiinthailand)

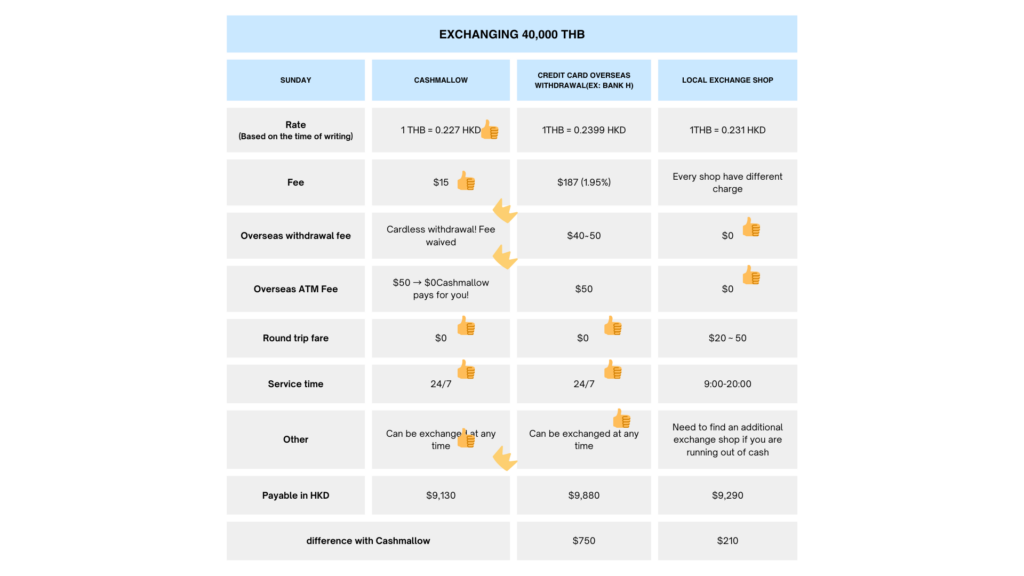

With Cashmallow, you can save up to HKD 700 compared to other currency exchange methods!

If you withdraw 40,000 Thai Baht overseas using a bank credit card, such as with Bank H, the process includes the bank’s exchange rate, transaction fees, credit card overseas withdrawal fees, and the ATM’s operational fees. After multiple charges, the total payment amounts to approximately HKD 9,880.

With Cashmallow, the exchange rate and a flat service fee bring the total cost to just HKD 9,130. This eliminates all mentioned overseas withdrawal fees, saving you around HKD 750!

(Image Source: 奇在泰國 Kiinthailand)

Features of Thai Baht Remittance

- Ultra-Fast Processing: Funds are credited within 5 minutes, eliminating the 3-5 business days wait typical with traditional banks.

- Transparent Fees: The actual payment amount is the exact exchange amount with no hidden fees.

- Low Flat Fee: A uniform fee of just HKD 12 significantly reduces costs.

- 24/7 Availability: Exchange anytime, anywhere.

Features of Thai Baht Exchange

Exchange Hong Kong dollars into Thai baht and withdraw cash at local SCB ATMs in Thailand—all without the need for a bank card or withdrawal fees. Both services are conveniently completed directly through the Cashmallow app.

- Ultra-Fast Processing: Complete foreign currency exchanges within seconds, saving time from long trips and queues at exchange shops.

- Transparent Fees: The actual payment amount is the exact exchange amount with no hidden fees.

- Low Flat Fee: Each exchange incurs a fee of only HKD 15.

- Zero Overseas Withdrawal Fees: No fees for overseas withdrawals. The ATM fee of 220 THB (approximately HKD 50) is covered by Cashmallow.

- 24/7 Availability: Cashmallow supports you anytime, day or night.

By using Cashmallow for foreign exchange, you can save over HKD 700! All transactions are conveniently handled directly within the app, significantly reducing both time and monetary costs. You can also monitor real-time exchange rates in the app and lock in favorable rates immediately. This helps you avoid unexpected rate discrepancies often encountered at currency exchange stores.

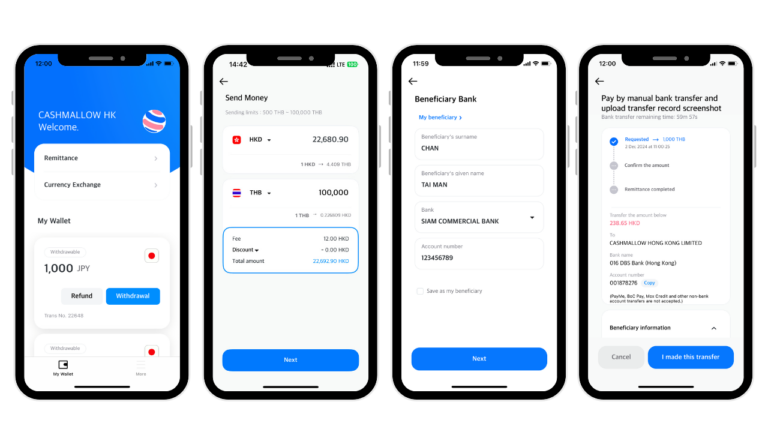

(Remittance steps in the app: Log in to Cashmallow, click Remittance > Select currency and enter the amount > Enter Thailand bank recipient details > Pay to Cashmallow)

Three Simple Steps to Complete Remittance:

- Apply for overseas remittance via the app.

- Visit the overseas location to withdraw.

- Done!

Three Simple Steps to Exchange Currency:

- Apply for currency exchange via the app.

- Visit the overseas location and use the app’s OTP or QR code to withdraw.

- Done!

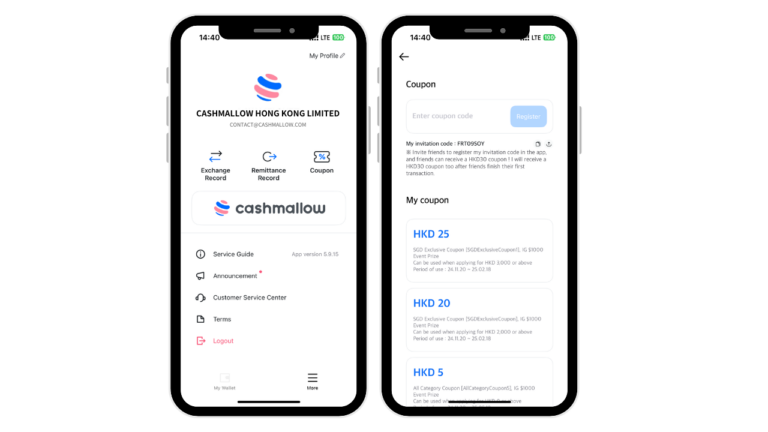

(Enter invitation code steps: Log in to Cashmallow, click More > Coupons > Enter the coupon code)

Join with an Invitation Code and Get Extra Coupons!

Simply join Cashmallow as a member, and you’ll instantly receive a coupon! To enjoy even more savings during currency exchanges, just click on the “Coupons” page in the app and enter the invitation code you received. You’ll get a coupon worth HKD 30!

These coupons come with no currency restrictions—exchange any currency you like. Plus, the coupon will automatically apply when you proceed to the foreign currency exchange page, making it even more convenient. This means Cashmallow is an even cheaper option compared to other exchange methods!